Under The Hood

Speed and Reliability Matter!

In a retail trading app, speed and reliability are not “nice-to-have”; they are the product. Speed matters because markets can move in sharp swings. Liquidity is opportunistic and time-boxed, so any latency between what the user sees, and the actual exchange order book increases the likelihood of slippage-and a mismatch between the trade intent and execution. Reliability matters because any glitch can translate directly into monetary loss, especially during volatile periods where fortunes are made and lost.

If a user can’t log in, see correct market data, or manage orders and positions, the platform puts them at a major disadvantage, creating ambiguity about their exposure and an inability to take timely action.

The engineers behind Tradesea™ bring more than two decades of experience building real-time, reliable systems, and the Tradesea architecture is designed to deliver both speed and reliability, even under extreme load or when individual components fail. This blog describes the specific software architecture and mechanisms we use to deliver that superior experience.

The Rithmic Simulator

Trader funding firms typically evaluate candidates in a “real-life” simulator that closely mirrors live market conditions. The goals are to:

- Allow traders to operate as they would in live markets with their own capital

- Enforce tight, predefined risk controls and guardrails which allow traders to learn about actions without risking capital

- Expose traders to varying market conditions and sustain the stamina required for executing trades

This approach helps traders develop skill and discipline while demonstrating consistency before being entrusted with the funding firm’s capital.

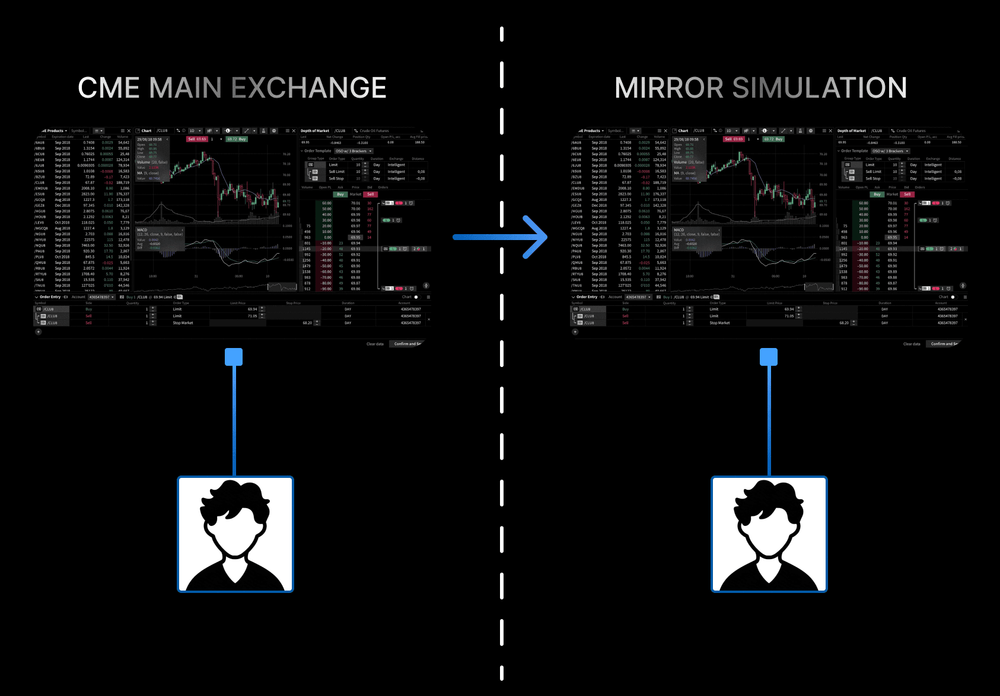

The Rithmic simulator provides a real-time mirror of the exchange (for example, CME) as illustrated in the figure below.

In this setup, live market data , including prices and full depth of book-is replicated into the Rithmic simulator in sub-millisecond timeframes, making it available to traders in the simulated environment with minimal divergence from the live feed.

Most other simulators take short-cuts (e.g. matching just with the last traded price), whereas Rithmic simulates the entire order queue and hence times the fills. Orders placed are matched within an isolated environment and routed through the risk-management guardrails configured by the funding firm (e.g., position limits, loss limits, max order size, and intraday controls).

This combination of high-fidelity market replay and strict risk enforcement creates a realistic training and evaluation ground, thoroughly preparing traders to transition to trading live with the funding firm’s capital.

Tradesea™ Architecture

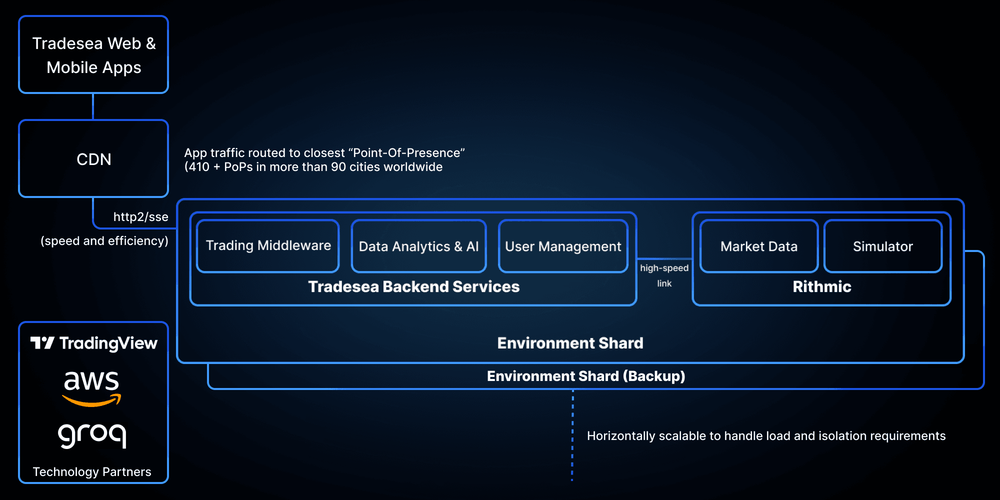

The Tradesea™ architecture consists of stateless microservices communicating with each other using high speed links and modern protocols (e.g. HTTP/2, Protobuf etc.).

To achieve Reliability, the architecture assumes that individual components (like servers) will fail and focuses on how the system recovers, without disruption to the traders. All the backend services that work together to provide the Tradesea™ experience are grouped together in “Shards”. Each logical shard includes all software services needed to service traders. Users are spread across shards, thereby enabling horizontal scaling and “blast radius” reduction. Also, each shard is mirrored by a backup so that if something goes wrong inside the main shard, a failover to the backup can ensue.

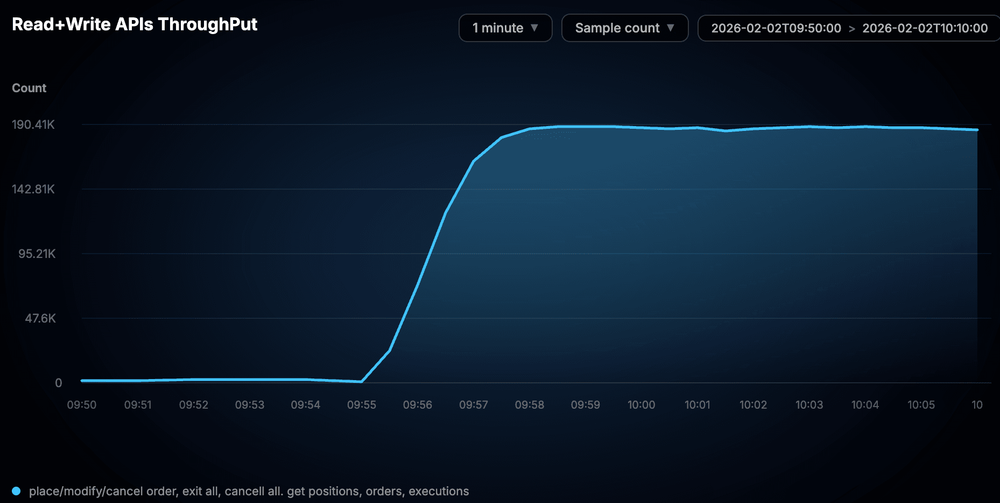

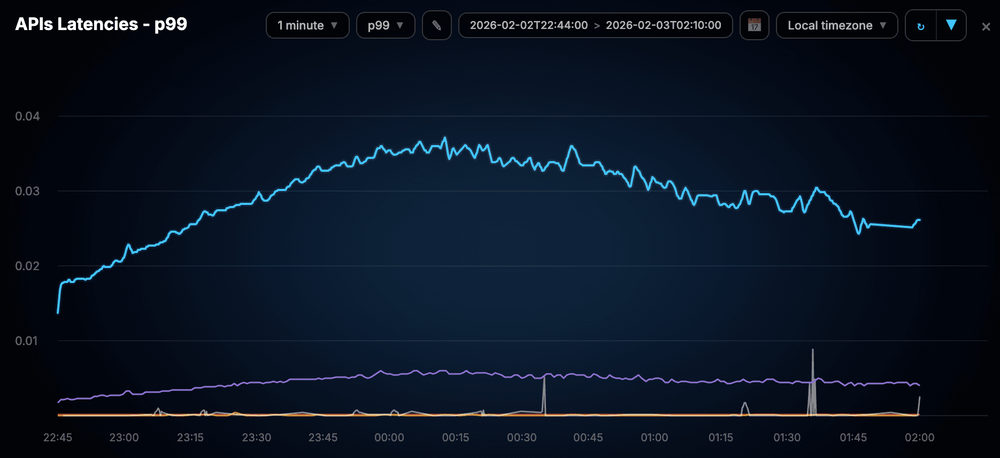

Below is a result of performance tests that we have done with our setup. We can sustain 190,000 requests per minute on a single shard with response time latencies under 10ms for 50th percentile and under 100ms in the 95th percentile of the requests:

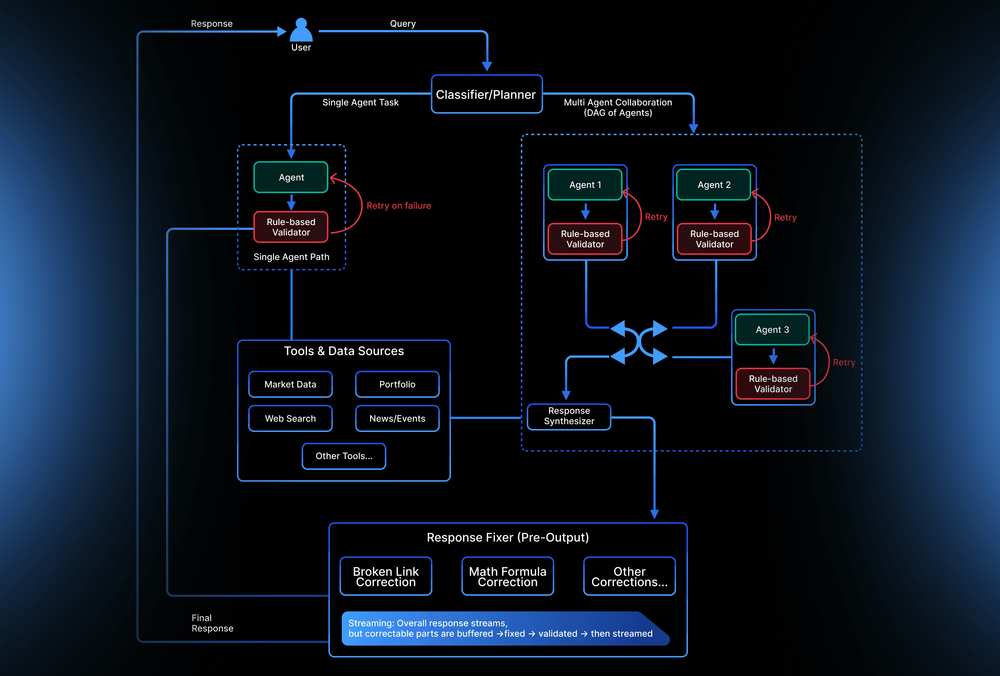

Data Quality is also a key factor in how users perceive reliability. A core part of the Tradesea™ offering is its AI ecosystem, called Polaris, where high-quality data and rich context are foundational. Polaris is an enterprise-grade AI platform built on carefully curated user and market context that translates user intent into precise, actionable outcomes.

At its core, Polaris employs a multi-agent architecture where a classifier/planner creates a Directed Acyclic Graph (DAG) of Agents and routes user requests through this graph. Each Agent is equipped with rule-based validators and retry mechanisms to ensure output accuracy. Before any response reaches the user, it passes through a Response Fixer that checks and corrects the final output against common checks for things such as malformed diagrams, broken links, and math formula errors. The system streams responses in real-time while intelligently buffering correctable segments for validation, delivering both speed and enterprise-level precision.

Performance is another key objective. The backend code is written in the Go programming language, enabling efficient modeling of highly concurrent workflows. Go’s lightweight goroutines, efficient scheduler, and predictable memory management make it well suited for low-latency, high-throughput systems. The standard Go runtime is further augmented with an in-house suite of optimized components, including zero-overhead queuing, custom memory pools, and lock-minimized data structures designed to reduce contentionunder load. This allows the system to scale linearly with load while maintaining predictable tail latencies.

These backend gains would be meaningless without a frontend that can keep up or ensure a high-performance trading experience. The web app leverages SolidJS’s signal-based architecture, and implements several critical frontend optimizations. For example, by utilizing virtualized lists for Market Depth (DOM), we reduced active rendering nodes by over 85%, ensuring fluid scrolling even with thousands of price levels. In addition, heavy computations are offloaded to Web Workers, combined with intelligent prefetching and network optimizations, to maintain a consistent 60 FPS UI.

Result

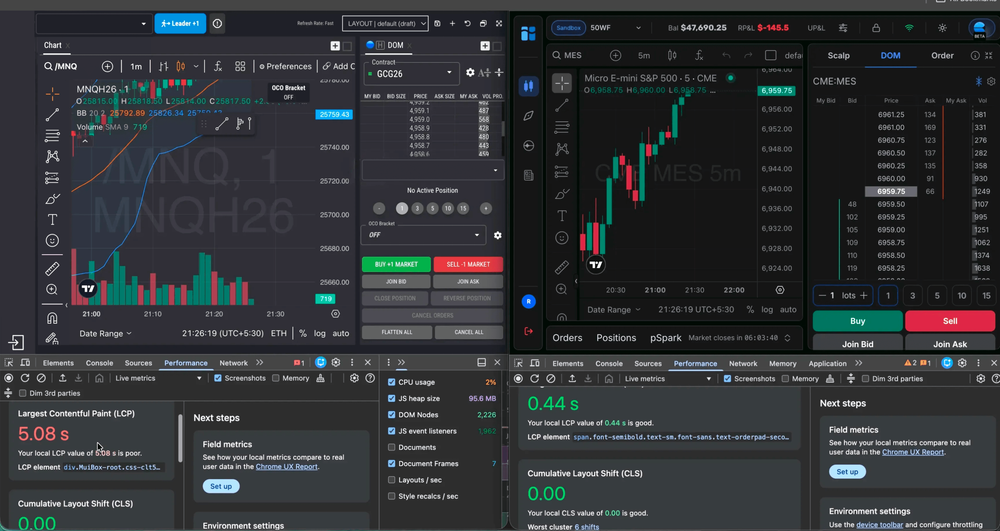

All these measures mean that the Tradesea app loads almost 6x faster than contemporary applications. The screenshot below shows the load (LCP – Largest Contentful Paint) time comparison in Chrome: 0.44s vs 5.08s load times!

This speed and reliability give traders a decisive edge-spotting opportunities and executing trades faster on TRADESEA™ !